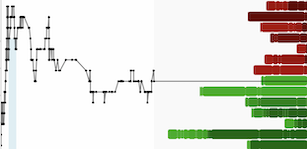

At time of writing the price of bitcoin is $3474 USD on Bitfinex (Hong Kong) and $3404 USD on Bitstamp (Luxembourg).

That is a spread of two percent.

With trading fees of less than 0.1 percent for Bitfinex and 0.25 for Bitstamp, such a spread should not exist in an efficient market.

In theory, an investor should be able to buy cheap bitcoin on Bitstamp, transfer the bitcoin to Bitfinex. Then sell the bitcoin on Bitfinex and wire the money to a Bitstamp account, and then rinse and repeat.

This arbitrage opportunity is not a momentary blip. I first wrote about the price disparity between Asia and the rest of the world last October.

At the time, I assumed the spread would disappear in a couple of weeks.. I was wrong.

How can such price disparity exist in such a supposedly liquid asset such as bitcoin?

One constraint is wire restrictions imposed by Bitfinex. Each account can only wire up $1 million USD a month otherwise a penalty of 3% will be imposed on the transaction.

At time of writing the price of bitcoin is $3474 USD on Bitfinex (Hong Kong) and $3404 USD on Bitstamp (Luxembourg).

That is a spread of two percent.

With trading fees of less than 0.1 percent for Bitfinex and 0.25 for Bitstamp, such a spread should not exist in an efficient market.

In theory, an investor should be able to buy cheap bitcoin on Bitstamp, transfer the bitcoin to Bitfinex. Then sell the bitcoin on Bitfinex and wire the money to a Bitstamp account, and then rinse and repeat

.

This arbitrage opportunity is not a momentary blip. I first wrote about the price disparity between Asia and the rest of the world last October.

At the time, I assumed the spread would disappear in a couple of weeks.. I was wrong.

How can such price disparity exist in such a supposedly liquid asset such as bitcoin?

One constraint is wire restrictions imposed by Bitfinex. Each account can only wire up $1 million USD a month otherwise a penalty of 3% will be imposed on the transaction.

Over the years, Bitfinex has been subject to several investigations by various US financial authorities and has had trouble finding a stable banking partner (although that can be said for many long-established crypto-exchanges).

Still, a Bitfinex account holder can wire $12 million USD a year from Bitfinex to other accounts.

Using just $1 million, an account holder could make $240,000 or 24%. Remember the trading and wiring fees are miniscule.

A twenty-four percent annualized return with no chance of downside in any other market is impressive.

But such is the wacky world of crypto, where investors turn up their noses at such a return.

Another mystery is who is buying the expensive bitcoin on Bitfinex?

Supposedly it’s not Americans, who are banned from trading (I am Canadian). As I have mentioned earlier, Europeans have Bitstamp and other exchanges where bitcoin is cheaper.

That leaves Asian buyers (mostly Chinese) and offshore corporations who must be doing the buying.

Bitfinex is only major Asian cryptocurrency that accepts the deposit and withdrawal of US dollars.

Binance, for example, only accepts bitcoin and other crypto-coins for deposit.

What conclusions can we draw?

Well if highest bitcoin prices in the world are in Hong Kong, then it stands to reason that there is more demand for bitcoin Hong Kong/China then there is supply.

This should be mildly surprising as most bitcoin is still mined in China. If miners sell at least some of their bitcoin that they mine daily, that should tamp down demand for bitcoin.

But it hasn’t.

Another mystery: Why doesn’t Bitfinex broker sales of bitcoin to the North American and European exchanges?

For example, let’s say Bitfinex holds 10,000 bitcoins for it’s customers in exchange wallets. What is to stop them from buying cheap bitcoin from Bitstamp and selling it to their customers?

Again, it must be banking restrictions. But is it really? We don’t know for sure.

Who Profits?

Anybody who can sell bitcoin on Bitfinex and buy the cheaper bitcoin in Europe or North America.

The list of investors who CAN’T do this arbitrage is smaller than the list who can.

1. US investors who don’t want to set up an offshore corporation.

2. Retail investors that cannot invest more than $10,000 US (Bitfinex wire minimum is $10K).

3. Investors that cannot pass the KYC (know-your-customer) test of Bitfinex.

And yet, the spread remains.

It’s a mystery.

DJ

.jpg)