Wall Street got what it wanted. After much speculation about the size of the rate cut, the US Federal Reserve met Wall Street’s highest expectations, slashing borrowing costs by a bold half-point.

With both the jobs picture and inflation softening, the Federal Open Market Committee (FOMC) opted to lower the key borrowing rate by 50 basis points, bringing the benchmark interest rate down to 5% from the previous 23-year high of 5.5%.

What’s more, policymakers now see rates at 4.5% at the end of 2024, suggesting another potential half-point reduction at one of the two remaining Fed meetings in November and December. Looking ahead, Fed Chair Jay Powell and his team are eyeing a target rate of 3.5% for 2025, provided inflation and employment trends continue to improve.

This is the first time in four years that the Fed has cut interest rates, aiming to ease monetary conditions and make borrowing more affordable. This is exactly what traders had been waiting for. So, are they celebrating? Yes — and no.

A rate cut of this magnitude raises concerns. Why would the Fed make such a drastic move if the economy were in good shape? Skipping the typical 25-basis-point cut in favor of a more aggressive 50-basis-point reduction suggests that the economy may be teetering on the edge of a possible recession.

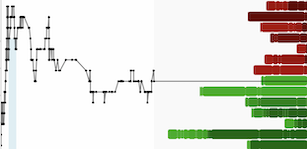

Global markets responded swiftly. After getting the rate cut they wanted, traders turned cautious, moving away from riskier assets.

XAUUSD surged to a new record of $2,600 — briefly. Moments after reaching this milestone, prices plummeted, returning to pre-surge levels.

Despite the short-term volatility, the gold bull market remains intact. The brief drop was just a blip in an otherwise strong year for the precious metal, which is up more than 25%, outperforming the S&P 500.

Speaking of the S&P 500, the index dipped 0.3% as investor sentiment turned cautious. Other major indexes also slipped into the red. The U.S. dollar weakened, with the dollar index falling to 100.50, its lowest level since July 2023.

The mixed reactions in the markets, reflect the uncertainty surrounding the Fed’s decision. However, with more rate cuts potentially on the horizon and borrowing costs easing, there is cautious optimism that the economy could receive the breathing room it needs to stabilize.

.gif)