Quebec Innovative Materials Corp. (QIMC) recently announced a significant hydrogen discovery on the east side of Lake Temiskaming.

In collaboration with the Institut National de la Recherche Scientifique (INRS), QIMC's soil sampling revealed hydrogen concentrations exceeding 1000 ppm in some locations, marking a major milestone in their exploration efforts. CEO John Karagiannidis emphasized the implications for clean energy, indicating a strong potential for commercial development in a 70 km² area within their 250 km² property. The results highlight QIMC's leadership in the hydrogen sector, with plans for further geological assessments and the development of sustainable technologies.

Weekapaug Lithium Ltd. (GRUV) has staked an impressive 2,100 hectares of mineral claims on the west side of Lake Temiskaming, focusing on the exploration of hydrogen, lithium, and other minerals. GRUV's claims are in proximity to documented occurrences of valuable minerals such as copper and cobalt. CEO Marc Branson expressed excitement about the acquisition, highlighting their commitment to developing these properties.

Comparison:

Discovery and Potential:

QIMC has already demonstrated a successful hydrogen discovery with substantial concentrations, positioning itself as a frontrunner in the hydrogen market. This concrete evidence of hydrogen presence enhances its investment appeal.

GRUV, while acquiring extensive land with potential for hydrogen and other minerals, has yet to showcase similar direct findings. However, the adjacent properties contain valuable mineral deposits, indicating good potential.

Market Position and Valuation:

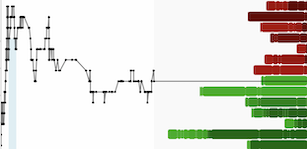

QIMC's recent market performance has seen an uptick (+10.13%), reflecting investor confidence following the hydrogen discovery. However, the valuation may be higher given its established presence and findings.

GRUV has the advantage of a lower valuation despite its growing claims and the "Hydrogen Gold Rush" context. This lower entry point could present a compelling investment opportunity, especially if future exploration validates the potential of their land.

Strategic Focus:

QIMC is heavily focused on hydrogen as a clean energy source, aligning with global trends towards sustainable energy solutions. This specific focus may attract investors seeking environmentally responsible opportunities.

GRUV's strategy encompasses a broad range of minerals, including lithium, which is critical for the renewable energy sector (batteries, etc.). That being said QIMC has interests in silica, and quartz as well.

Conclusion: While QIMC has made a significant hydrogen discovery that may appeal to investors looking for immediate results in the clean energy sector, GRUV offers a more diversified portfolio with significant land holdings at a potentially undervalued price. The company’s broader mineral focus, coupled with the ongoing hydrogen exploration, suggests strong future prospects. Thus, GRUV may be a better buy, especially for investors looking for growth potential in a burgeoning sector while benefiting from a cheaper valuation.

$GRUV $QIMC